Let’s get prepared for the coming week of 1-29-2024!!

We have lots of earnings and macro data coming up this week.

Yellen’s bill issuance announcement on Monday. Consumer Confidence and JOLTS job openings on Tuesday. ADP Nonfarm payrolls, FOMC on Wednesday, Jobless claims, and ISM manufacturing PMI on Thursday, and we have Non-farm payrolls on Friday.

The Sentiment below shows that we have an Extreme Greed reading at 77. This sentiment reading can go higher, but this tells us to be cautious with longs. And maybe time to add some hedges.

As mentioned in previous videos and also write-ups we are overbought and we could pull back anytime. I have written that I am trading a bit less because the risk-reward is less on the long side.

Now on to the indices analysis:

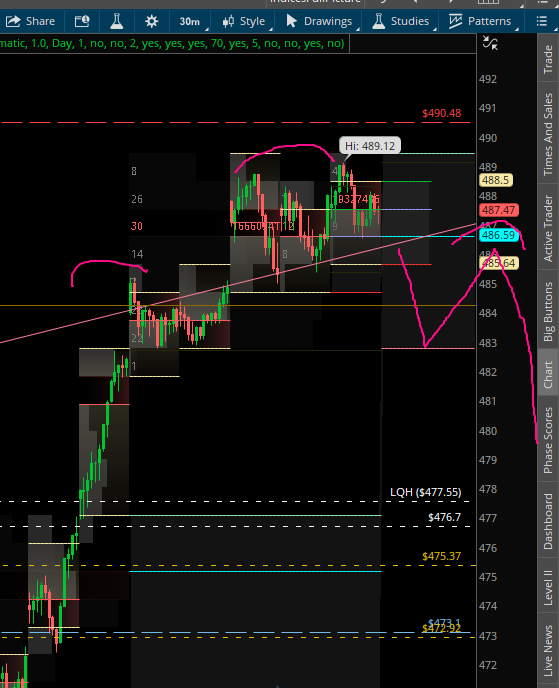

SPY: It is above the broadening formation. We could go 483 and then pop to test the broadening formation upper line again to 487. Thus forming a H&S pattern.

If we go through with the H&S pattern then the targets below are shown. This could take to the 478 level.

QQQ: This week all the big tech reporting. Q’s would move a bunch.

And yet it shows like a downtrend channel that can be followed with every earnings that comes out.

IWM: Everyone thought IWM would break down. But it gets bought. Even after this buying, IWM is in a range. This week with FOMC, we could see us resolution this range in IWM.

Now to the earnings analysis:

The below chart as a courtesy from Earnings Whispers.

MSFT: $20 expected move. The expected move means that MSFT could go up $20 or go down $20. I do not intend to trade MSFT from the long side before earnings. I intend to wait to see the reaction and then follow in the direction of the reaction. If we go 370 or so in MSFT after earnings, it may be better to buy a call debit spread then.

AMD: It has $17.5 expected move. Approximately the expected move matches exactly with my multiple fibs targets. Again do not want to chase this performance and buy more of AMD.

GOOGL: If we look at the expected move for GOOGL then it is around $8. But last time market reaction to GOOGLE’s earnings was pretty bad, it went almost 2.5 times the expected move. If we are going to repeat the reaction from last time then on the topside, we could be looking at 165-170. If GOOGL’s earnings reaction is bad then I am looking at 140 as support.

META: $28.5 expected move. The expected move to the downside looks interesting on META. I would like to buy META again if it tests the upper trendline. I am not interested in the upside targets for now.

AMZN: $28.475 expected move. Since AMZN is not at ATH’s, this year may be its chance to shine. This is 1 place where I would look to do a CDS for earnings.

AAPL: $7.21 expected move. I do not think AAPL is done going up. I think the $200 price level gets tested this week on AAPL.

Most of the stocks that matter have earnings this week and hence the market outlook tonight became a stock review session.

The plan is set.

Disclaimer: This is my trading plan on the indices. This is intended to be for educational and informational purposes only. Trading is risky and loss of capital is possible. Do your own diligence. In trading, there are no guarantees. So please be careful risking capital.

Share this post