This podcast/write-up is for the coming week from Jan 8th to Jan 12th.

Weekly outlook for the indices, sectors, and stocks that can be played this week.

Dollar: There is a slight bullish divergence on the daily chart. This bullish divergence and the weak indices for 1st week of Jan caused a small spike in the Dollar. But the weekly chart is still looking bearish for the dollar.

TLT: I am looking to buy the dip in TLT. But I am waiting for it to reach the 93-94 level before buying the dip. If 92-94 level does not hold in TLT then we will have bigger problems with the indices going forward.

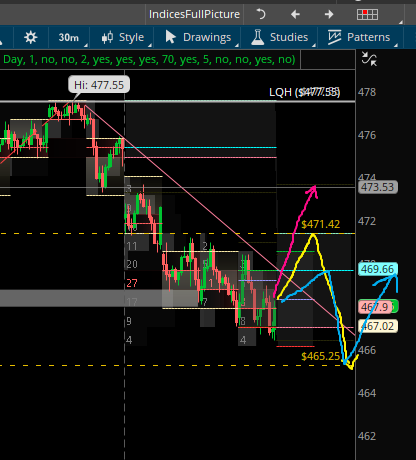

SPY: We can gap up on Monday, and get to 469.66 or 471.42 before CPI on Thursday, and then based on CPI and JPM earnings either get to the 473.25 to 474 level or we retest 465 level that we tested in the pre-market session on Friday.

3 different possibilities have been laid out and shown on the chart.

QQQ: weekly bearish divergence on Q’s still there.

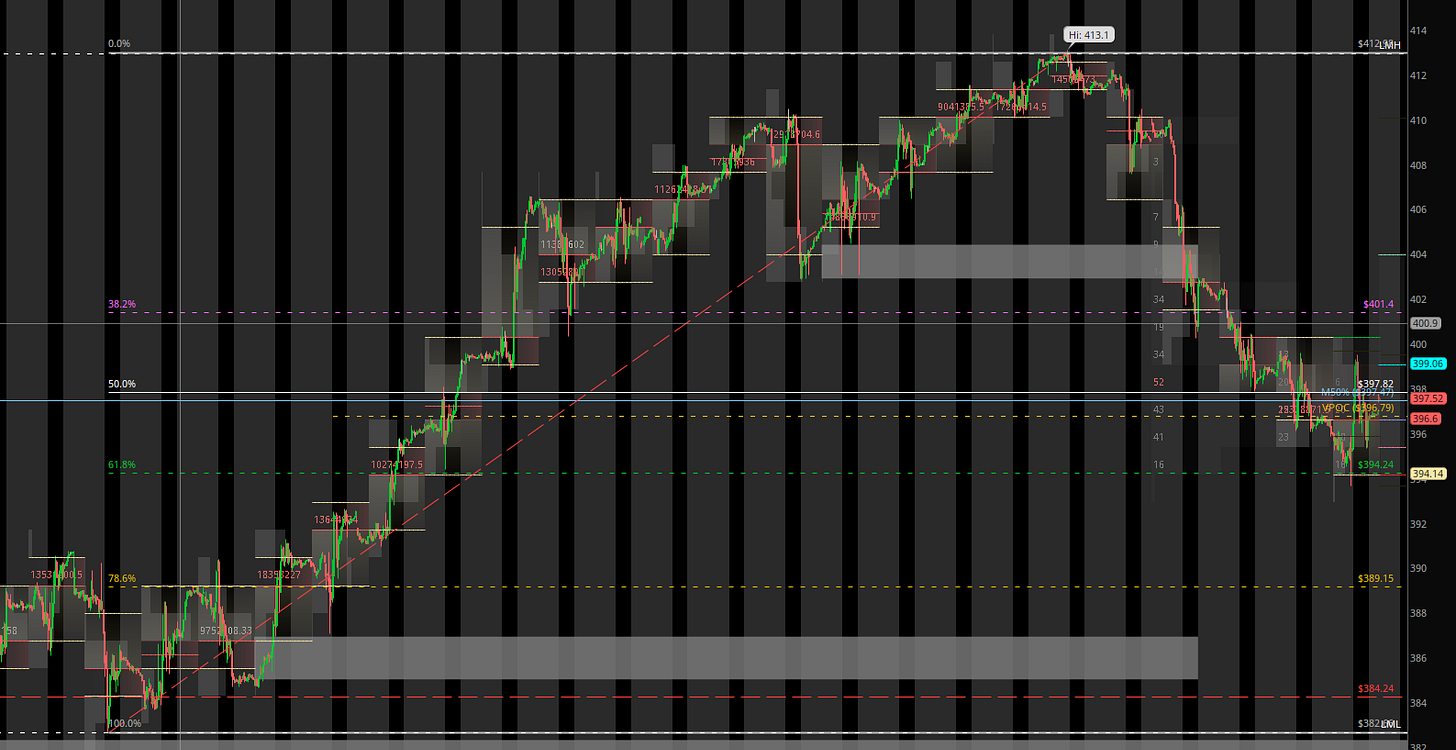

The Q’s came to 61.8% retracement from Dec 4th low at 394.22 and bounce. So, now I looking for a bounce to 401.4 to 402 level. If the CPI and PPI this week are higher than expected then we can retest that 394.22 again.

DIA: This week DIA is the most important index. We have BA news about their MAX planes being grounded. We have UNH, JPM reporting their earnings. We have the JPM annual health conference. AMGN, MRK, JNJ part of the DIA too. We have TSM reporting and that can affect MSFT, and AAPL also.

DIA is also the index that held up last week when all other indices were red big.

Any close below 370 can lead to a bigger flush in the DIA. But this would also mean that the other indices are weak too.

IWM: IWM along with Q’s were the most hit last week. IWM has many financials. And we have so many financials reporting on Friday- Jan 12th. JPM, BAC, and WFC are among the few.

I am looking to buy IWM if it gets to the 185 - 187 level.

Bitcoin is in no man’s land for me. My analysis from last week stands. I want to short BTC at 48K and buy the dip at 36K

GLD: I want to buy GLD at the 184 level. I am looking to sell put credit spreads on GLD below the 180 level.

Sector overview:

XLK: Technology sector: We have bearish divergence on the weekly. It closed below the 8wk MA. So this is bearish. the 38.2% retracement is at 180.65. Looking for a bounce at this level. Pre-earnings run in tech in possible after this kind of a pullback in the XLK.

SMH: TSM reports this week. TSM has more than 9% weighting in the SMH ETF.

So TSM earnings and guidance can take SMH to 160 or 172.

XLV is the sector that has gone sideways for the last 2 years. And now about to break out of this 2-year range. We have the JPM healthcare conference this week. Let’s see if we get the breakout this week.

Some notable earnings to look forward to: TSM, DAL, TSM, JPM, BNY, KBH

The only pre-earnings trade I am thinking of is going long DAL via leaps.

If CPI is lower then I am looking to play WFC long for earnings via a call debit spread.

The plan is set.

Index Income Trades from Archnatrades is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Also if you have any questions about my trades you can DM me on Twitter at @archna2011

Disclaimer: This is my trading plan on the indices. This is intended to be for educational and informational purposes only. Trading is risky and loss of capital is possible. Do your own diligence. In trading, there are no guarantees. So please be careful risking capital.

Share this post